Can Figuratively speaking Be used to Pay rent?

Figuratively speaking are often used to buy room and you can panel, which has both towards the- and of-campus housing. Therefore the short answer is sure, youngsters may use money from the money to blow monthly book to own renting and other kinds of quarters off campus.

not, the fresh property area one students chooses is also significantly change the price of a college education. Education loan debt is at a the majority of-time high which have youngsters due roughly $step one.5 trillion when you look at the student education loans at the time of , considering Forbes. And with the escalating can cost you of university fees and you can property, just how many education loan borrowers-already labelled in the 49 billion-does still rise nationwide. Now, inside your, youngsters need certainly to extend its figuratively speaking in terms of it is to fund as much of one’s tuition and you can housing costs you could.

Key Takeaways

- Student loans can be used to buy space and you can board for a qualified student.

- Universities spend university fees and you can college or university-related costs out-of an educatonal loan just before unveiling one fund to help you be taken to possess casing-relevant expenditures.

- On-university housing can be more affordable, since it does away with dependence on seats, safety deposits, and energy costs.

- Students should weigh the expense away from way of living off and on-campus and exactly how far capable pay for.

Insights College loans and Housing Costs

Most people remove student education loans to help counterbalance the will set you back regarding the blog post-secondary education, including houses costs. The average number of education loan financial obligation transmitted from the consumers of the class regarding 2017 was almost $31,100000. Consequently, you will need to contrast the costs regarding living towards the-university and you may out of-university.

Regardless if a student-based loan are often used to safeguards for the-otherwise away from-university housing, going for a dorm will help reduce your cost. Extremely dorms already been supplied-at least that have a bed, agency, and you can dining table about room, reducing the requirement to pick furniture. Some universities even are restaurants within casing costs. As a result, aside from the sporadic midnight meal and you may any additional ingredients, most college students is protected. In addition to, off-campus construction, such as for instance a flat, generally demands a safety put and college students have the effect of the fresh new tools, like temperatures and you will fuel. But not, dorms not one of them a safety put, and you may resources are part of the overall homes statement throughout the college.

Dorm against. Off-University Houses Costs

Considering My personal University Publication, an average cost of living during the a school dormitory at an effective public school regarding the U.S. are $8,887 or $ten,089 in the a private college or university. One to contour shall be higher if you decide to are now living in a fraternity otherwise sorority housepare one on mediocre rent getting a one-bedroom apartment in the united states, and this lies at the $959 per month. The local rental amount will not become items, furniture, utilities, and other housing-associated costs.

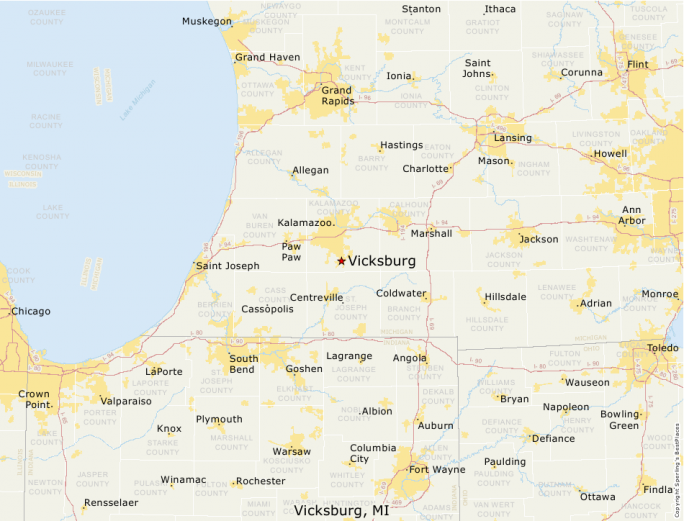

As well as, off-campus houses is sometimes more pricey on metropolitan areas, as there are significantly more competition for it. For example, if you find yourself likely to a large-name college when you look at the a city, such New york city, Chi town, Boston, otherwise La, expect you’ll rating hit with an enormous costs-just to suit your university fees however for most will cost you particularly construction. If you find yourself good You.S. citizen or eligible noncitizen, you could potentially sign up for federal financing, offered you really have a high-school degree or similar certification, while https://www.cashadvancecompass.com/loans/sunday-payday-loans/ have to be signed up for an eligible college.

The earlier you understand in which you should alive-on the or away from-campus-the earlier you could evaluate how much money you would like. It is vital to complete the Government App at no cost Beginner Support (FAFSA) as quickly as possible on the early in the day academic year.

Student loan Disbursements

Very you have been acknowledged for the student loan. Great! But, cannot believe in using all of that money for the homes as of this time. Remember, advanced schooling establishments spend the university fees or other school-relevant costs basic, especially if you aren’t searching another educational funding instance Pell Grants or scholarships. The institution will likely sign up for the money out of your loan proceeds to cover their for the-university construction too if you’re surviving in the dorms.

Immediately after these types of expenditures is paid back, the institution supplies you with one left loan currency-constantly because of the lead put to your a checking account. It matter can be, naturally, be used for rental, so you can begin writing down the book monitors if the you’re going to real time regarding-university.

Should you decide when deciding to take a complete course load and have no financial aid apart from figuratively speaking, you really need to comprehend there will never be adequate mortgage money left over to shell out month-to-month rent having a whole session or educational season. Planning ahead and making sure adequate school funding exists to pay for university fees, charge, and you may rent is essential.

Dealing with Disbursement Delays

College or university financial aid departments try not to disburse kept education loan money up until following start of informative seasons, and landlords usually need shelter dumps and you may month-to-month book timely. If you find yourself seeking to from-university homes, factors to consider you have got adequate money to fund these types of can cost you, if regarding friends benefits otherwise part-go out a position, up until it found its education loan disbursement. As an alternative, your pus houses. By discussing your living space, you might decrease how much cash you borrowed from on rent all of the month, and any kind of casing-associated expenditures such as for instance resources and you will food.